Companies are hiring across state borders or across oceans. While this practice opens doors to phenomenal talent, it also brings with it a sticky problem: worker misclassification. Governments globally are clamping down on firms that incorrectly (or purposefully) characterize workers as independent contractors. The penalties are steep: hefty fines, back wages, and even brand damage.

This is where EOR Payroll steps in. An Employer of Record (EOR) not only makes hiring easier but also ensures workers are classified and paid accurately. Let’s break this down simply.

What Is Worker Misclassification?

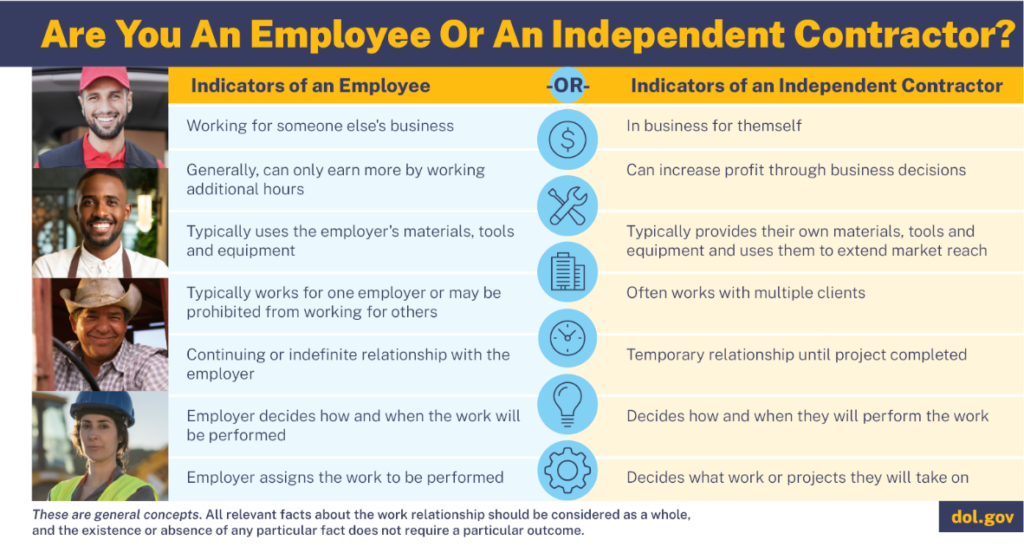

Simply put, misclassification occurs when an employer regards someone as an independent contractor when, legally, they are an employee.

For instance: If you dictate an employee’s work hours, provide them with company equipment, and monitor their day-to-day job, the law will usually treat them as an employee—and not a contractor.

And if you misclassify them as a contractor, you may avoid paying taxes, benefits, and insurance that employees are required to have.

In America, the IRS estimates that billions in tax dollars are lost annually due to misclassification. Other nations, including the UK and Australia, have equally stringent rules to safeguard employees.

Why Misclassification Is Such a Threat

Misclassification is more than an administrative error. It can result in:

Penalties of law: Governments can fine employers and require them to make back payments of wages and benefits. According to the IRS , businesses face strict penalties if workers are wrongly classified as contractors instead of employees.

Tax issue: Businesses can be prosecuted for unpaid payroll taxes.

Employee lawsuits: Employees can sue for lost wages, overtime, or wrongful dismissal.

Reputation damage: A public suit can damage your company’s reputation, particularly in competitive markets.

The Department of Labor highlights that misclassified employees often lose access to overtime pay, health benefits, and workplace protections.

In a nutshell: neglecting rules of classification can cost much more than money.

Where EOR Payroll Comes In

An Employer of Record (EOR) is your workers’ legal employer in a specific country. You’re in charge of the day-to-day work, and the EOR takes care of compliance, payroll, and HR administration.

EOR Payroll expressly guarantees that:

- Employees are accurately classified. The EOR understands local regulations and applies the correct employment model.

- All the payroll taxes are taken care of. From social security to income tax, the EOR gets it right.

- Benefits are complaint. Healthcare, paid leave, or retirement contributions are established based on the rules of the country.

- Contracts are legally sound. The EOR establishes contracts that satisfy local regulations, lowering your exposure to the law.

How EOR Payroll Prevents Misclassification

Here’s why EOR Payroll is such a powerful protection:

Local labor law expertise

There are specific regulations in each country for determining contractors versus employees. An EOR possesses in-country experts familiar with the difference and are able to implement it properly.

Straightforward employment arrangements

By engaging the worker through an EOR, you sidestep the “grey area” of contractor relationships. The EOR actually employs the worker, eliminating uncertainty.

Proper payroll processing

Misclassification is usually conspicuous when payroll records don’t meet the requirements. EOR Payroll removes this threat as it ensures taxes, benefits, and deductions are applied accurately.

Less liability for the business

With a reliable EOR, you offload legal responsibility as the employer of record. This implies that the liability for compliance doesn’t rest on your shoulders.

Example- Suppose a U.S. startup employs a skilled marketer in Germany and labels them a contractor. The marketer has fixed working hours, uses company programs, and reports to the startup manager. According to German law, that individual is obviously an employee—not a contractor.

If there’s no proper classification, then the company faces fines, back taxes, and legal woes.

Now, if the startup employed the marketer through EOR Payroll, the EOR would legally hire the marketer in Germany, place them on compliant payroll, and administer benefits. The startup gets the talent nonetheless—but without the legal hassles.

Conclusion

Misclassification of workers is one of the largest compliance exposures for contemporary companies. While governments move to clamp down, the risks of making a mistake are only getting bigger.

Companies do not want to be bogged down by complicated labor laws. They want speed, compliance, and peace. EOR Payroll delivers just that:

- A smoother journey to global growth.

- Peace of mind against legal and financial dangers.

- Peace of mind knowing workers are paid consistently and compliantly.

In short: If you’re hiring globally or managing a distributed team, EOR Payroll could be your safest path to growth without misclassification risks.